Within the double materiality assessment you will find the concept of “IROs” – Impacts, Risks and Opportunities. Depending on what you stage in the materiality assessment you are facing, but sooner or later you must pass the IROs. When I read about IROs, I always read it in combination and estimated that it is one concept, but it isn’t. We need so split Impacts off from Risks and Opportunities. Impacts are the foundation of impact materiality while Risks and Opportunities are the compounents of financial materiality.

Let’s have a look on the different flows of impacts, risks & opportunities

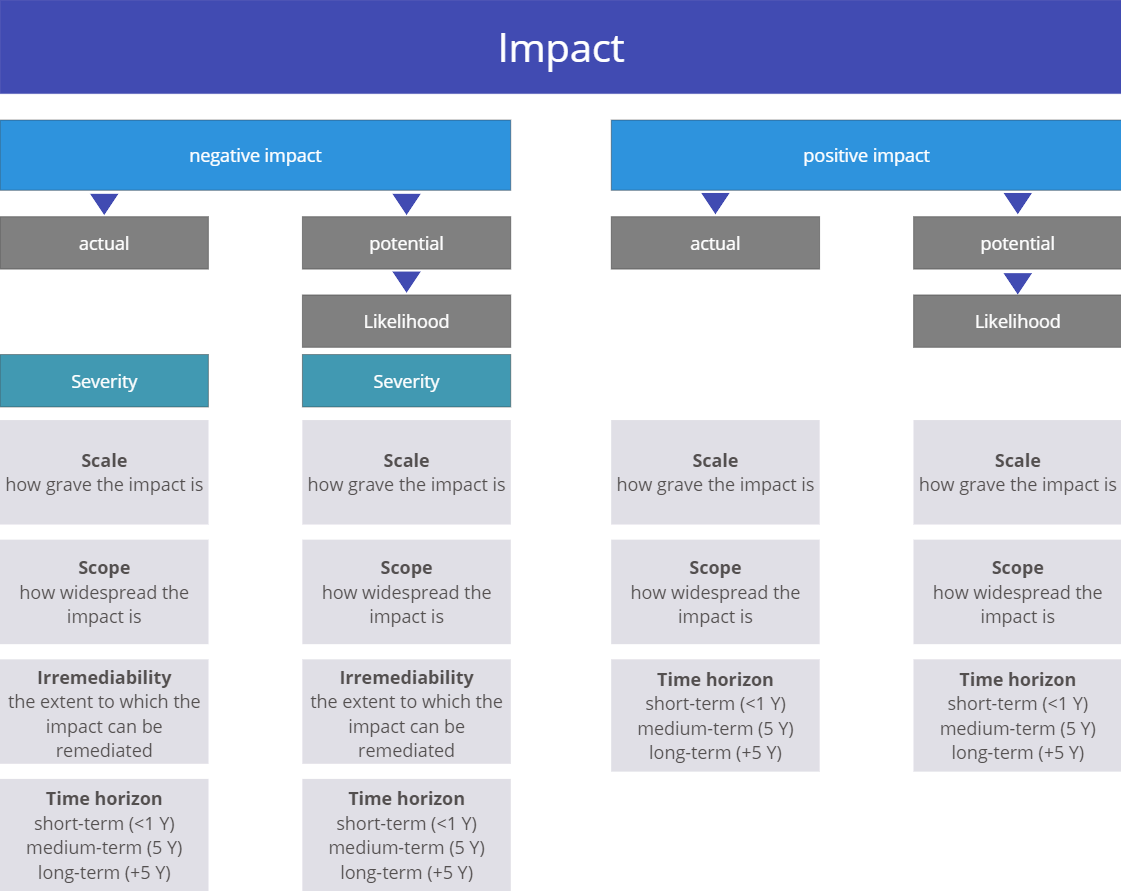

Impacts (Impact materiality):

You can see that the concept of impacts is not even the same. EFRAG focused on negative impact and extended the concept by positive impacts later on. The score of materiality that you have to create comes from scale, scope and irremediability. Time horizon and the likelihood of occurence is not taken into account for the definition of materiality.

Risks & Opportunities (Financial materiality):

The financial materiality assessment is nothing that is invented by EFRAG. Here you can see that we split “RO” into Risks and Opportunities. The two factors that have to be taken into account to calculate a score is the potential magnitude of financial effects and the likelihood of occurence.

“IRO” is more than just some dots on a matrix if you want to do it correct. The Impacts, Risks and Opportunities have to be rated, the average rating decide if the topic is overall material or not. A lot of efforts are leading in just one small matrix. But it is worth it to do this exercise .. you learn a lot about your internal dependencies and your business model.